Taxes | W2 Statements

Sign Up for Electronic W-2

It’s safe and convenient. Your W-2 can’t get lost, stolen, or misplaced and you can download/print at any time.

- Go to UCPath online and click on Income and Taxes > Enroll to Receive Online W-2.

- If the current status says CONSENT RECEIVED, no action is required – you are already signed up for the electronic statement.

- Once signed up, all notifications pertaining to your W-2/W-2c will be sent to your preferred email address on file in the UCPath system – make sure it is correct.

- UC does not send actual W-2 statements to employees by email or text. You SHOULD NOT open any attachments or click on any email links that claim to give access to your W-2! If you receive an email or text that has a link or an attachment for viewing your W-2, it is a phishing scam designed to gain access to your private information. All employees must sign in to UCPath to view/print their electronic W-2.

If you chose paper delivery of your W-2 it will be mailed on or before January 31. It will be identical to the version available online. Your W-2 is available online whether you opt-in or opt-out of electronic delivery

View and Print your W-2

Tax information deadline

UCPath begins processing W-2s in late January. To ensure the information on your W-2 is complete, accurate, and reaches you, please take the following steps:

- Verify your personal email and home address in UCPath online. Even if you opt for a digital W-2, it’s important that UC can reach you.

- Verify your dependents. The Affordable Care Act (ACA) requires UC to make reasonable efforts to obtain Social Security numbers for employees, their spouses/domestic partners, and dependents. To review or update your information, log in to UCPath online, then select Employee Actions > Health and Welfare > Dependent Coverage.

- Review your personal delivery option for W-2. Online W-2s are easy, secure, and oh-so-convenient! To check your status:

- Log in to UCPath online, then select Employee Actions > Income and Taxes > Enroll to Receive Online W-2.

- If it says “CONSENT RECEIVED” you are signed up for online delivery and will NOT receive a paper copy in the mail; if you want to reverse this choice you will need to check the box.

- International workers: Verify your GLACIER account information. International employees may receive a W-2 or 1042-S (Foreign Person's U.S. Source Income Subject to Withholding). To ensure your tax information is sent correctly, verify that your personal email and home addresses match exactly in UCPath online and the GLACIER tax database. You may also opt to have an electronic 1042-S through GLACIER. Learn more about Form 1042-S.

Important security reminder

UC does not send W-2 statements by email or text. If you receive an email or text with a link or an attachment for viewing a W-2, it is a phishing scam designed to gain your private information. Do not open attachments or click email links that claim to provide access to your W-2. To access your electronic W-2, always go to UCPath online using a safe/known link.

Federal and State Earned Income Tax Credit (EITC or EIC)

- Per the Earned Income Tax Credit Information Act, UC includes a notice with all Form W-2 statements notifying employees that they may be eligible for the federal EITC. This is a benefit for working people with low to moderate-income. To qualify, you must meet certain requirements and file a tax return, even if you do not owe any tax or are not required to file. EITC reduces the amount of tax you owe and may give you a refund. For more information about the federal EITC, reference IRS Notice 797 or contact the Internal Revenue Service at (800) 829-3676 or via www.irs.gov.

- You also may be eligible to receive the California EITC, starting with the 2015 tax year. The California EITC is a refundable state income tax credit for low-income working individuals and families. It is treated in the same manner as the federal EITC and generally will not be used to determine eligibility for welfare benefits under California law. To claim the California EITC, even if you do not owe California taxes, you must file a California income tax return and complete and attach the California EITC Form (FTB 3514). For information on the availability of the credit, eligibility, how to obtain necessary forms, and help filing, contact the Franchise Tax Board at (800) 852-5711 or via www.ftb.ca.gov.

Claiming Exemption from Withholding

The IRS requires you to complete a new W-4 form each year if you are claiming exemption from tax withholding.

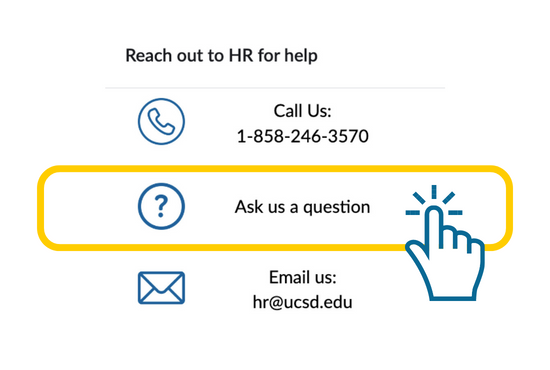

Have questions or need help? Log in to UCPath and select Ask UCPath to submit an inquiry. You may also call UCPath to speak with an associate at (855) 982‐7284 from 8 a.m. to 5 p.m. (PDT) Monday through Friday.

W2s Statements FAQs

Note that W-2s report wage payments dated in the calendar year. Monthly wages and some biweekly wages earned in December are paid in January of the following year. It is not unusual for someone to leave their job in December and receive their last payment in January of the following year.

Consider the following:

- Regardless of when you earned the income, the W-2 reports income paid in the calendar year.

- Form W-2 reports only taxable earnings, which may not equal total gross earnings. If they're different, you will not find your total earnings on Form W-2 taxable wages for tax reporting purposes, such as 403(b), Defined Contribution Plan (DC Plan) retirement, UCRP retirement, parking, health insurance premiums, Health Flexible Spending Account, and Dependent care flexible spending accounts.

- Example: If you contributed $100/month to a retirement plan (DCP or UCRP), your taxable earnings (box 1 and box 16) will be $1200 less than your gross earnings. Retirement contributions won't be taxed until you withdraw them.

- Review the earnings statement for the last pay date in the year. The number on the "TAXABLE GROSS EARNINGS" line of the "Year-to-date earnings/ded" column should match Box 1 of your W-2. The number on the "CA ST TAXABLE GROSS EARNINGS" line of the "Year-to-date earnings/ded" column should match Box 16 of your W-2.

- If you claimed a tax treaty between the U.S. and your home country that exempted you from federal tax on salary/wage income, that income will not be reported in box 1 of your W-2. Instead, it will be reported on Form 1042-S. If you're not a citizen of the U.S., a difference between boxes

- Fellowship income is not reported on Form W-2.

- If you were a citizen or resident for tax purposes, it is your responsibility to report and pay any tax due on fellowship income. See "General Tax Information" under "U.S. Citizen/Permanent Resident/Resident Alien" heading on the Grad Student Tax Information page, or the Tax Information arrow on the Benefits & Services tab of the Office for Postdoc and Visiting Scholar Affairs website.

- If you were a nonresident for tax purposes, fellowship income will be reported on Form 1042-S, which will be available on or after March 15, 2017, via Glacier or mail . Nonresident alien grad students can get more information about this by clicking the "General Tax Information" tab under the heading "International (Nonresident Alien)" section of the Grad Student Tax Information page. Postdocs can get more information on the taxation section of the Benefits & Services tab of the Office for Postdoc and Visiting Scholar Affairs website.

Address changes don't require a W-2 correction. If the tax authorities need to contact you about your tax return, they will send mail to the address you enter on your tax return forms (1040 or 592).

DCP (Defined Contribution Plan) is not a tax; it is a mandatory savings plan for retirement purposes.

For tax reporting purposes, wages are reported when they are paid, rather than when they are earned. December earnings for all monthly and some biweekly employees may be paid in January of the following year.

The following deductions reduce your federal (box 1), Social Security (box 3), and Medicare (box 5) wages:

The following deductions reduce only federal (box 1) and state (box 16) grosses:

FICA tax comprises the Social Security tax withheld (box 4) and Medicare tax withheld (box 6). Add these two items together and the sum should equal the FICA tax deduction displayed on your last paycheck of the year.

UC does not deduct SDI from your paychecks, so it is not reported on your W-2 statement.

UCSD's FEIN is 95-6006144. You'll find it in box b of your W-2.

Tax information and resources

Get Local UCPath Support

Contact our local UCPath Support team through the Employee Center.

Submit a Ticket